Politics of the debt crisis

Rescuing colourful news metaphors: From diversionary politics to reformist agendas?

Denis Bright invites readers to take

note of the communication roles played by colourful news metaphors in

Australian politics.

The capacity of exotic news metaphors

in pictures, graphics and colourful texts to explain complex issues is

balanced by an awareness of their potential as agencies of political

persuasion.

Hypotehtical exclusive news scoop – from the Prime Minister’s flight deck.

Warning from Captain Abbott: Rough landing ahead at New Australia

Veer right after the debt

sign. Your Captain will take advantage of the head-winds generated by

our recent unpopular budget to make a difficult landing. Which policy

metaphor lever should I use, Crew to divert attention away from this

electorate’s real issues of concern?

sign. Your Captain will take advantage of the head-winds generated by

our recent unpopular budget to make a difficult landing. Which policy

metaphor lever should I use, Crew to divert attention away from this

electorate’s real issues of concern?

In the disciplined world of mainstream politics, leaders and their

advisers routinely make use of colourful news metaphors to simplify

domestic and international policy issues.

Spontaneous political metaphors from door-stop interviews have quite

determined links to thoughtful policy radar assessments of the issues of

the week.

Eyewitness news services soon want to be involved in the political game.

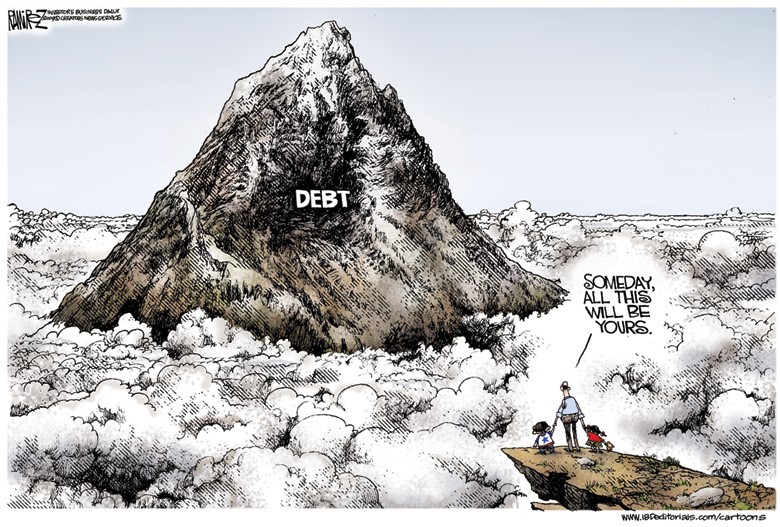

Readers of this hypothetical cartoon from a regional paper in New

Australia would have been familiar with the recent news feed about

Barnaby Joyce’s explanation of a self-perceived Australian public debt

problem:

“If you’re trying to turn the finances of our nation

around, there are going to be hard decisions that are made. And if we

don’t, we go broke,” Mr Joyce said on ABC radio.

“This is our first budget, I understand the concerns people have, I

fully understand them, but what is our alternative? We either accept

that we’ve got a debt problem and we’ve got to turn it around or we

basically we say ‘no, this is only a small melanoma on our arm, and if

we just wait long enough it’ll go away’. (From The Australian, 25 August

2014).

Political diversion strategies were successfully applied on the Prime

Minister’s hypothetical visit to the regional city of New Australia.

In the true genre of strong LNP leaders, metaphors were rattled off

about the choice of the correct flight path for hard-times now and in

the troubled times ahead for the global economy.

Winners are always grinners: On both sides of the political divide (Source: Namoi Valley Independent)

Reassuring commitments to market forces abounded as media releases

talked-up the bright future ahead if more legislative barriers to dry

economic agendas could be reduced.

Entrenched privilege was protected by the Prime Minister’s failure to

open up debate about the need for a simpler and fairer taxation system

that can deliver essential services and new infrastructure without

ongoing budget deficits.

The cheer squad for the Prime Minister in New Australia included many

local elites who have routinely benefited from the current taxation

loop-holes relating to negative gearing on rental properties and

payments of cash wages to casual employees.

A more exclusive circle included representatives of mining

entrepreneurs and other corporations from the mining sector. This sector

has a long tradition of siphoning off potential Australian Taxation

Office revenue through payments to commercial associates in overseas tax

havens.

Colourful news metaphors in mainstream political processes as diversionary political strategies

Populist communication strategies have worked well on both sides of

Australian politics. The election of Kevin Rudd in 2007 with the

assistance of the Your Rights at Work Campaign is the most recent example.

Historically, the federal ALP has scored well in developing news

metaphors with strong links to popular consensus-building policies.

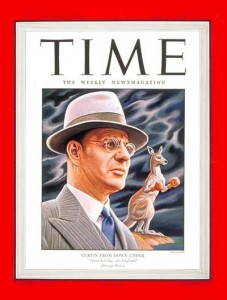

Prime Minister John Curtin became an Australian and international icon as shown by this cover from Time Magazine on 24 April 1944 in recognition of his efforts are wartime leader.

With the guns silent, Ben Chifley won the 1946 elections to achieve

the federal ALP’s last majority in both houses of parliament from the

positive spin from domestic reform agendas and an active commitment to

peace and disarmament.

Prime Minister Chifley’s agenda was far less left wing than his news

metaphors suggested. Federal Labor faced a challenge from the support

base of the Communist Party in some heartland electorates and it was

appropriate to keep industrial unions onside with the ALP.

More recently, Opposition Leader, Bill Shorten, has gained impressive

traction in generating head-winds against the recent LNP budget. The

federal ALP has been up to ten points ahead of the government in

post-budget polling after the allocation of preferences.

Prime Minister Abbott has sought diversions in switching news

metaphors from financial austerity to foreign policy, defence and

terrorism concerns with some successes in recent polling.

Federal Labor: Marketing a successful reform agenda for Prime Minister Ben Chifley (image from News Corporation)

However, the summary of the opinion polls to 11 September 2014,

suggests the federal ALP still maintains a firm vote on the back of

additional support for the Greens which the current foreign crises have

generated.

Federal Labor must now go beyond its own successful opportunistic

rhetoric to link its protest messages to alternative policy frames which

offer some relief from financial austerity and constant involvement in

foreign conflicts.

One shaky LNP myth is the notion that the level of government in Australia is indeed excessive.

Tilting at LNP news metaphors about excessive levels of government in Australia

While still being identified with calls for financial austerity and

cut-backs in government spending, Prime Minister Abbott is not carried

away by the literal meaning of his own populist political communication.

Technical advisers have attended to shortfalls in the federal government’s own revenue base.

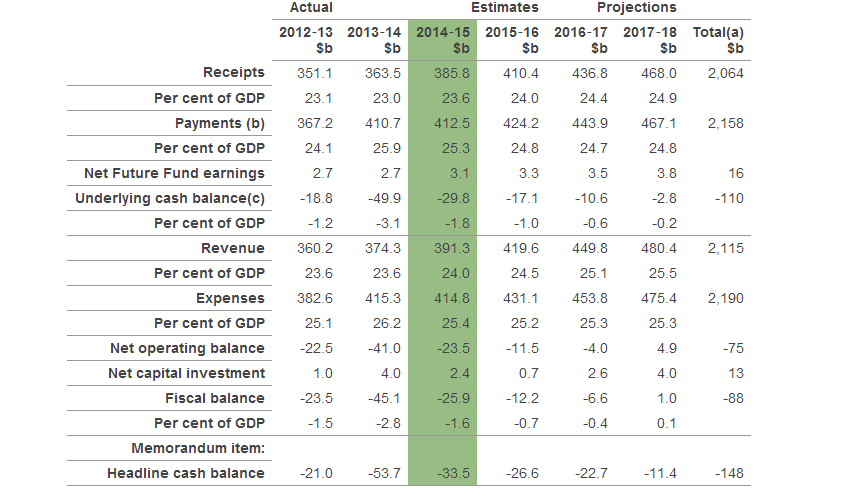

The federal budget revenue, as a percentage of gross domestic product

(GDP), is projected to increase to 25.5% by 2017-18 from 23.6% in Wayne

Swan’s last budget.

Without this increase, federal and state governments would be financially unsustainable.

In economic management, Prime Minister Abbott is not quite as ideologically driven as his government’s news metaphors suggest.

Synopsis of Budget Aggregates

Australian Budget 2014-15. Appendix A

This budget repair initiative by the LNP could provide the rationale

for similar major initiatives by federal Labor through tax reform

measures.

Such progressive initiatives could be justified by greater honesty

about Australia’s lean public sector when comparisons are made with

other OECD countries.

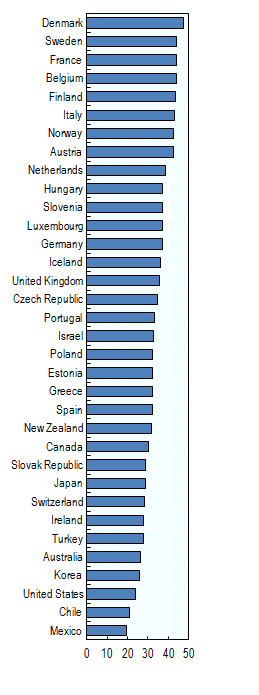

On the latest comparative OECD data for revenue as a percentage of

GDP for 2011, Australia is thirtieth on the list of thirty-four member

states.

Hardliners in the federal LNP would like to move Australia down the

list to compete with the neo-conservative countries at the bottom of the

barrel.

However, the LNP’s love of military commitments makes this literally impossible.

The news metaphor of the high tax Australian state

Can alternative news metaphors be constructed?

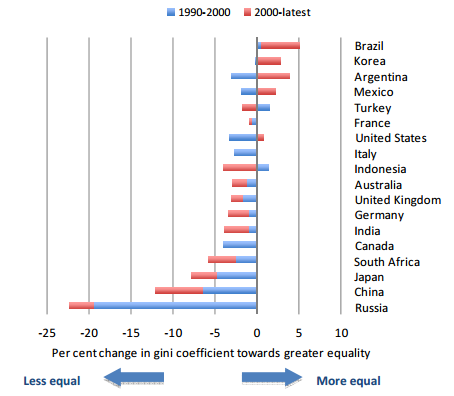

Overseas experience suggests that most corporately driven societies cannot hold the line against a growing wealth divide.

In more competitive societies, the wealth divide usually increases as

the remnants of social democracy are eroded by privatization as well as

cut-backs in services and industrial awards.

The LNP’s silence about the need for tax reform in Australia actually

protects wealthy families and corporations from making an appropriate

contribution to an improvement in the government’s revenue base.

The notion that everyone benefits from economic rationalist

strategies, as advocated by the LNP, is not evident in data from Oxfam.

None of the developed economies listed has achieved a more equitable

income distribution since 1990 with the exception of a slight

improvement in the USA, thanks to the presence of President Obama’s

domestic initiatives.

Ironically, the US remains one of the most unequal societies in the

developed world and the Abbott Government is committed to moving

Australia in this direction.

The return of the wealth divide

Oxfam 2012. Left Behind by the G20?

The challenge of the wealth divide demands more than a piecemeal

rejection of just some of the Abbott Government’s commitments to more

middle class welfare.

Federal Labor can construct defiant metaphors which are linked to

viable policy alternatives to the current near hegemony of dry economic

agendas by LNP federal and state governments.

The Murdoch press is of course no friend of the federal ALP. Even the biased headlines in The Australian could not hold the line against the depth of post-budget reactions from across the community.

Reporting the Address in Reply: With editorial metaphors embedded in the headlines

The Australian Online.16 May 2014

Perhaps the next conviction of a prominent wealthy tax evader or

errant corporation could be the trigger for a real debate about the need

for a simpler and fairer taxation system in Australia.

Addressing the profound levels of inappropriate taxation leakages

that benefit wealthy families, entrepreneurs and corporations is an

essential priority for all reasonable federal governments.

In every country town and regional districts, constituents are well

aware of the extent of tax leakages through payment of cash wages as

well as the conspicuous display of wealth from the misuse of family

trusts and family companies to achieve legal avenues for systematic tax

avoidance.

Laundering of money through overseas-based management funds and

diversion of company profits to offshore tax havens is less obvious. It

is well reported in news and current affairs programmes.

Cost estimates of the extent of these leakages should be part of the national public debate.

Progressive representatives on parliamentary committees have the

capacity to request appropriate estimates of tax leakages from the

Australian Tax Office, the Australian Crime Commission, the Australian

Transaction Reports and Analysis Centre (AUSTRAC) as well as other

relevant agencies.

As recommended by Taxpayers Australia, some new anti-avoidance

legislation is also required to manage rorts by some of Australia’s

wealthiest entrepreneurs, families and companies.

Anti-avoidance strategies are recommended by Taxpayers Australia:

- trading in franking credits (buying and selling shares just to

claim the franking credits without holding on to them long enough to

bear ownership risk) - personal services income (diverting income that is earned through your efforts into another entity with a lower tax rate)

- foreign income deferral (accumulating income in a country with lower tax rates)

- employee share schemes (receiving shares as remuneration and delaying the ‘taxing point’)

- company tax losses (companies cannot claim prior year losses

unless the majority of the ownership has not changed hands or unless the

same business activities are being carried on) - trust tax losses (trusts cannot claim prior year losses unless certain tests are passed)

- taxation of minors (punitive tax rates apply to minors under 18

years of age to prevent streaming income to children on lower tax rates

than the rest of the family).

Taxpayers Australia 2014

Associate Professor of Taxation Law at the Australian School of

Business at the University of NSW, Dale Boccabella, has made a number of

technical submissions to control the inappropriate leakage of taxation

revenue through the misuse of family trusts.

Speaking on The Drum, Dale Boccabella makes the following recommendations:

On the other hand, the generous tax treatment of

discretionary trusts (family trusts) is not included in the tax

expenditure statement – but there are good reasons why it should be. The

negative gearing loss on rental properties and share investments is not

included either. For 2012-13, the Commonwealth has around 280 tax

expenditures under the income tax, worth around $100 billion. This is

around 6 per cent of GDP. Direct expenditure of the Commonwealth for the

same period was around $360 billion, which is around 24 per cent of

GDP. (ABC.The Drum 12 March 2014).

If the current deficit problem is considered in this context, a different interpretation of The Age of Entitlement soon emerges.

Every billion that is leaked from the federal treasury through

inappropriate tax avoidance has a flow-on effect to the deficit problems

of the states and territories where tied grants are the key variable in

budget processes.

Opposition parties have nothing to lose by broadening the debate about the continued Age of Entitlement.

Playing the news metaphor game: The silence of most state and territory leaders

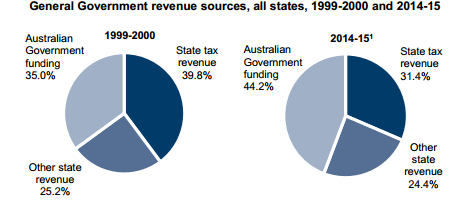

Failure to act on federal taxation reform has inevitable negative

effects on the deficit problems of the various states and territories.

The election of Prime Minister Abbott has not really assisted Premier Campbell Newman’s debt reduction strategies in Queensland.

Like the other states and territories, Queensland is increasingly dependent on the Commonwealth for its revenue base.

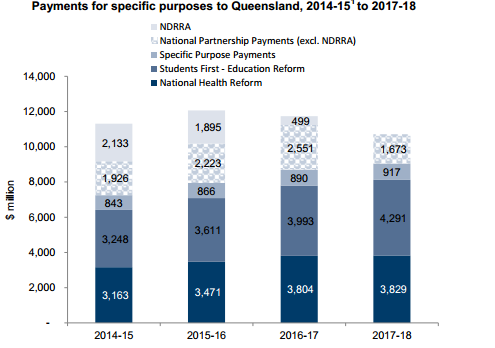

Queensland Budget 2014. Paper 2:6,107

The Queensland Budget Papers for 2014-15 show that 46 cents in every

dollar of state revenue (44.2 cents in all states and territories) are

derived from the Commonwealth through both GST revenue ($11.736 billion)

and specific grants ($11.313 billion).

Queensland is still the beneficiary of tied grants negotiated with

the former federal Labor Government which delivered an additional

windfall of almost $3 billion during 2013-14.

This financial glow will deteriorate as the financial austerity of

the Abbott Years takes its toll on future levels of grants to the states

and territories.

The news metaphors invariably project Queensland budget deficit as a

purely local problem to justify the austerity measures imposed by

Premier Campbell Newman.

In the absence of federal tax reform initiatives, the delivery of

essential services and infrastructure at state and territory levels will

become more challenging.

Queensland Budget 2014-15. Paper 2:6,121

Progressive representatives at both state and federal levels have

little to lose by talking up strategies for real solutions to budget

deficits.

Towards alternative news metaphors embedded in bold policy frames

In economic policies, progressive parliamentary representatives could

unite in constructing news metaphors about the value of a simpler and

fairer taxation system which protects the leadership role of the

Commonwealth in revenue collection.

The electorate can then balance the social costs of more financial

austerity with the value of more middle class welfare and tax anomalies

that protect wealthy families, rich entrepreneurs and many of

Australia’s leading financial corporations.

The politics of cynical diversion

The most potent policy frame for progressive representatives in state

and federal parliaments is of course the persuasive power of reasonable

alternatives.

Source: Herald Sun

One place to start is the parliamentary finance committees at both

state and federal levels to expose the real injustices of current

taxation arrangements which make commitments to essential services a

luxury.

Professor John Quiggin of the Economics School at the University of

Queensland explained to a supportive audience at the Brisbane Workers’

Club on 26 August 2014 that commitment to taxation reform as a way out

of current deficit problems would be a real challenge.

Exotic news metaphors from the LNP to divert attention away from dry

economic and foreign policy agendas definitely exert powerful social

controls on political debate.

The sustainability of this spirit of protest will be vastly extended

if the federal ALP Policy Review Committee can use alternative metaphors

to support new pragmatic consensus-building policies that talk-up

Labor’s economic management credentials.

The sheer complexity and injustices of the current Australian

taxation system justifies more news metaphors which promote a real

reform agenda to end the diversionary politics of Prime Minister Abbott

at the end of his first term in office.

Denis Bright is a member of the

Media, Entertainment and Arts Alliance (MEAA). He is a registered

teacher with post-retirement studies in journalism, public policy and

international relations.

Denis Bright

No comments:

Post a Comment