Submission to Pink Batts' Royal Commission (Part One): Extraordinary success in averting recession

Following his reports on economic stimulus in Independent Australia and elsewhere, Alan Austin offered to appear before the Royal Commission into the just commenced Home Insulation Program (HIP). Commissioner Ian Hanger AM QC responded requesting he present a sworn statement of evidence to the Commission.

AA SUBMISSION TO HIP ROYAL COMMISSION

(This piece is part one of Alan Austin's sworn submission

to the RC into the HIP and has been only edited (slightly) for format.)

Seven important aspects of the findings of previous HIP investigations appear problematic.

None so far appears to have analysed the program’s overall costs and

benefits. None has determined the extent to which it served to avert

recession. None has measured the lives saved and other personal, social

and economic benefits delivered by its rapid implementation. And none

has explored the extent to which enemies of the then federal government

distorted and falsified claims about the program.

Part 1: Success of the 2009-10 stimulus in averting recession

In 2007 Australia was one of the world’s better-managed economies.

Depending on the formula used to measure and compare economic health,

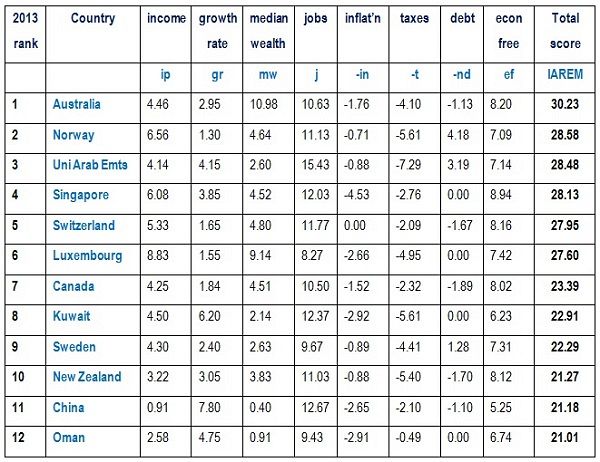

Australia ranked between 8th and 12th globally. Chart A, below, published in Independent Australia,

shows 2007 rankings using scores derived from a transparent formula

using eight variables – income, growth rate, median wealth, jobs,

inflation, taxation, government debt and economic freedom. [1]

Chart A: Top 12 economies in the world in 2007 ranked in order by IAREM score.

Raw data for the IAREM – Independent Australia’s ranking on economic management – is from the World Bank, the International Monetary Fund, Credit Suisse and other sources.

Australia in 2007 was 9th on the IAREM ranking, only bettered by

Norway, Iceland, Luxembourg, Kuwait, Finland, Hong Kong, Singapore and

the United Arab Emirates.

All developed economies were then impacted severely by the global

financial crisis (GFC). Markets collapsed and workers lost jobs in their

millions. All governments scrambled to respond. Only one developed

nation emerged almost unscathed from that turmoil.

By 2011-12 Australia found itself clear world leader on economic wellbeing.

According to Economic Roundup: Issue 2, 2011, by the Australian Treasury:

'Australia was one of the few advanced economies that avoided

recording at least two negative quarters of economic growth over this

period. During the most acute period of the global recession Australia's

economy slowed but it did not experience the large sustained

contractions experienced in many other countries over the same period.' [2]

Only two member nations of the Organisation for Economic Cooperation and Development (OECD)

avoided two negative quarters of gross domestic product (GDP) growth

through 2008 and 2009. Thus only two averted recession (defined in

Europe and Australia as two consecutive quarters of declining GDP).

These were Australia and Poland. Poland’s stimulus spending response was

second highest in the OECD, second only to Australia’s.

France, Germany and Austria experienced four negative growth

quarters. Canada, Japan, Sweden and the USA went backwards in five

quarters. Luxembourg, Norway and Britain fared worse with six negative

quarters. Denmark and Finland both experienced a disastrous seven, while

Iceland, Ireland, New Zealand and Spain all had eight or more.

The advice Australia’s government accepted was thus proved sound. Treasury again:

'The rapid deployment of fiscal stimulus appears to have been

effective in increasing domestic demand, with transfers in late 2008 and

the first half of 2009 boosting household consumption and putting a

floor under business and consumer confidence … Fiscal stimulus estimates

imply that growth would have been negative for three consecutive

quarters absent fiscal stimulus.' [2]

This opinion was shared worldwide, including by Nobel Prize-winning economist Joseph Stiglitz of Columbia University:

“Kevin Rudd … realized that it was important to act early, with

money that would be spent quickly, but that there was a risk that the

crisis would not be over soon. So the first part of the stimulus was

cash grants, followed by investments, which would take longer to put

into place. Rudd’s stimulus worked: Australia had the shortest and

shallowest of recessions of the advanced industrial countries.” [3]

Note: the definition of recession used by some in the USA is one negative GDP quarter.

The human cost in joblessness and poverty following the devastation of the GFC was enormous in most developed countries. According to tradingeconomics.com,

unemployment increased in Denmark from 1.7% to 4.4%, in New Zealand

from 3.9% to 7.0%, Canada from 5.9% to 8.7%, the United Kingdom from

5.3% to 8.0%, the USA from 4.9% to 10.0%, Ireland from below 5.0% to 13%

and Cyprus from below 4.0% to peak eventually above 16%. [4]

The same fate was forecast for Australia, based on trends in late 2008. Allan Hawke wrote in his Review of the Administration of the Home Insulation Program:

“There was little economic optimism at the time. Before the stimulus,

unemployment was forecast to reach around 10 per cent by mid-2010 with

the highest impact expected on lower-skilled workers. Negative economic

growth was forecast for 2009, with the construction industry being

particularly affected.” [5]

As it happened, Australia’s jobless rate rose, but not disastrously, from 4.2% to 5.8%. [4]

By 2010, Australia was almost universally seen as having the world’s

best-performed economy. The evidence strongly suggests Australia’s

continuing buoyant economic activity was the result of the unique

stimulus implemented by the then federal Government.

At the end of 2013, according to analysis published in Independent Australia, Australia’s economy continued to lead the world on IAREM scores derived from the eight variables:

Chart B: Top 12 economies in the world in 2013 ranked in order by IAREM score. [6]

The quantum, speed and direction of the stimulus spending, notably the rapid cash handouts to households, the HIP and Building the Education Revolution, clearly had the desired effect.

Authorities to have reached this conclusion, besides Australia’s

Treasury and Columbia University’s Joseph Stiglitz, above, include:

UNICEF consultant Bruno Martorano:

'While European countries implemented austerity measures

worsening social conditions of their population and pushing the economy

into a fallacious fiscal adjustment, the prompt reaction of the

Australian government limited the possible negative effects caused by

the macroeconomic shock and favoured the process of economic recovery.' [7]

Sydney University’s Emeritus Professor Rodney Tiffen:

'As a tool of economic policy, the stimulus worked. Although

other factors, including the strong demand from China and the sound

position of Australia’s banks, were also important, the stimulus played a

central role in making sure that Australia suffered less of a downturn

than most other developed countries.' [8]

Australian Industry Group’s Heather Ridout: [9]

“The package targets consumer spending, which is absolutely

critical to our near-term economic prospects, and boosts capital

expenditure — looming as one of the real casualties.”

Australian Trade Commission’s Tim Harcourt:

'… the fiscal stimulus has clearly helped. Australia went hard

and went early and put resources in the right places. As a result,

Australia was the only advanced country to have reported positive

through-the-year growth to June 2009. It's no wonder the international

commentators have been talking about Australia's ‘miracle economy' going

from "down under to down wonder".' [10]

Lowy Institute for International Policy director Mark Thirlwell:

'Although some of the details of these fiscal stimulus packages

have since been the subject of domestic political criticism,

international organizations such as the International Monetary Fund and

the Organisation for Economic Co-Operation and Development have praised

Canberra’s response.' [11]

You can follow Alan Austin on Twitter @AlanTheAmazing. Coming soon: Part Two. The critical rapidity of home insulation.

REFERENCES

1. http://www.independentaustralia.net/politics/politics-display/the-worlds-best-economy-part-two-winners-and-losers-through-the-gfc,6304

2. http://www.treasury.gov.au/PublicationsAndMedia/Publications/2011/Economic-Roundup-Issue-2/Report/Part-2-The-key-quarters

3. http://www.project-syndicate.org/commentary/the-crisis-down-under

4. http://www.tradingeconomics.com/country-list/unemployment-rate

5. http://ee.ret.gov.au/review-administration-home-insulation-program-hawke-2010

6. http://www.independentaustralia.net/politics/politics-display/australia-tops-the-iarem-worlds-best-economy,6279

7. http://www.unicef-irc.org/publications/697

8. http://inside.org.au/a-mess-a-shambles-a-disaster/#sthash.Dgfr8rM1.dpuf

9. http://www.sbs.com.au/news/article/2009/02/03/stimulus-package-gets-thumbs

10. http://www.smartcompany.com.au/growth/export/12304-20091130-the-great-escape---how-australian-exporters-survived-and-even-thrived-in-the-gfc.html#

11. http://www.psmag.com/magazines/magazine-feature-story-magazines/australia-economy-recession-53744/

John Graham's art is available for purchase by emailing editor@independentaustralia.net. See a gallery of John's political art on his Cartoons and Caricatures Facebook page.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

No comments:

Post a Comment